SHARE

Virtual CFO Spotlight: Driving Financial Transformation and Operational Efficiency by 74% in Just Four Months.

This case study shows how data-driven budgeting and forecasting with targeted scenario analysis led by virtual CFO supported the digital agency’s mission to build brands sustainably.

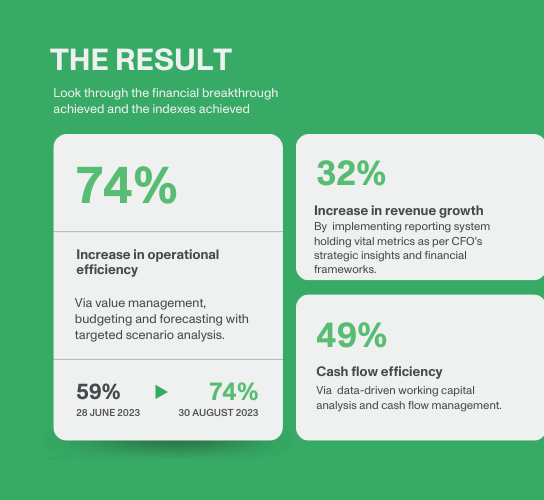

An established digital agency, spanning 16+ industries required an intricate balance between maintaining financial control and fostering creative freedom – a balance that our interim C-suite team were adept at managing and challenges our interim chief financial officer met strategically. The outcome? Our virtual CFO and timeshare service helped them achieve a 20% decrease in cash burn rate, 49% increase in cash flow efficiency and furthermore helped them reallocate funds to a high-yield digital initiative which accelerated their revenue growth by 32% – all within months from the date of operations.

The challenges:

The digital agency faced a common challenge: balancing robust financial management with the creative freedom needed to thrive. They juggled diverse teams of storytellers, analysts, and artists, requiring specialized oversight to align finances seamlessly with their multifaceted projects. The misalignment between their financial operations and creative goals caused budget overruns and resource constraints – stifling creative potential and leading to compromised project quality. Here’s how this translated into specific hurdles:

- Cash flow fluctuations and suboptimal capital allocations led to financial instability, making it difficult to cover operational costs and unexpected expenses.

- Lack of data-driven financial forecasting and strategic insights resulted in delayed project starts, hindered creative efforts, and created stress around meeting financial obligations on time.

- Lack of standardized global financial oversight and framework, the agency often faced compliance issues and inefficiencies in financial reporting, breaking trust with stakeholders and complicating strategic decision-making.

- Inflexible budgeting platforms were unable to adapt to variable project demands, leading to misallocated resources and limiting the ability to respond to changing market conditions and affecting profitability.

- Inadequate financial reporting systems within their legacy ERP led to poor visibility in financial health and performance and overextended resources, compromising both operational effectiveness and growth.

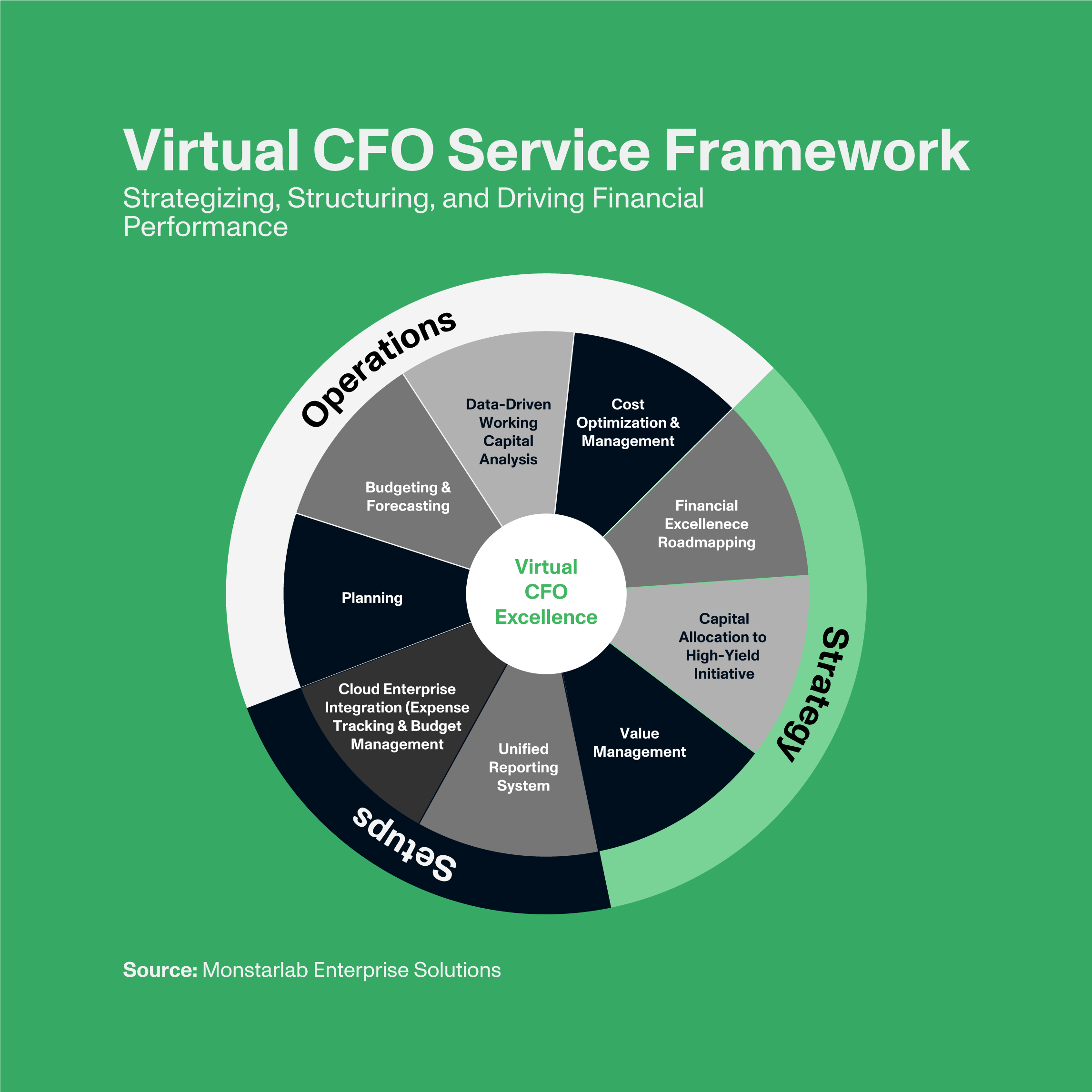

Our approach:

Our virtual CFO and interim C-suite executives guided them with systematic approaches, cost optimization, cash management and turnkey cloud financial transformations services across various scopes, industries and projects. By implementing a modern budgeting process integrated with cloud enterprise solutions as expense tracking and unified reporting system, the virtual CFO and timeshared service enhanced the agency’s overall financial process. This cohesive approach supported their mission to build brands sustainably and develop result-driven outcomes.

Let’s Work Together

Get In Touch

The results:

- Increased 74% operational efficiency via value management, data-driven budgeting and forecasting with targeted scenario analysis.

- Increased 32% revenue by implementing unified reporting system holding vital metrics as per CFO’s financial frameworks coupled with in-house ERP team.

- Yielded 49% cash flow efficiency via data-driven working capital analysis and cash flow optimization and management.

See the Transformation: Virtual CFO Pdf

Download Brochure

Our

Insights

Transformation in Automotive Business Operations with Odoo ERP | Case Study

Pharma Sales Revamped with CRM and ERP | Uninson Homoeo Case Study

Our

News

NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

Fostering innovation and technology to pioneer business resilience and operational excellence.

Connect with us

Monstarlab Enterprise Solutions.

Let us know who you are and how we can help and one of our team will connect with you.